Audits have always been a part of every business to ensure compliance and process qualities. Generally speaking, audits can range from financial to inventory to people and processes. Many of the audits align themselves with applicable standards and aim to comply successfully.

Multiple audits standards are available and each is applicable under some predefined circumstances. Examples of some widely adopted standards include:

- The Payment Card Industry Data Security Standard (PCI DSS) is an information security standard for organizations that handle branded credit cards from the major card schemes.

- HIPAA (Health Insurance Portability and Accountability Act of 1996) is applicable in the United States and provides data privacy and security provisions for safeguarding certain health and medical specific information

- ISO/IEC 27001:2013 (Information Security Management Systems) defines a framework for effectively managing security risks to well differentiated domains of acompany’s critical assets including manpower and confidential information.

- SOX ( Sarbanes-Oxley Act of 2002) aims to increase transparency in corporate governance and financial reporting to protect shareholders and the general public from accounting errors and fraudulent practices in enterprises. SOX is applicable to all publically held companies in the US.

Third party auditor (TPA) to provide objective assurance and audit services designed to monitor and assess the conformance by the operating agency and add value to improve the performance of the organization. The third party audit agency (TPA) will audit the operations and management, security and compliance with standards and processes of the organization.

The Role of TPA comprises of the following:

- Administrative control of data and its confidentiality, security and privacy is with the organization.

- Significant financial, managerial, and operating information is accurate, reliable, and timely.

- Interaction with the various stakeholders occurs as and when needed.

- Risks are appropriately identified and managed.

- The auditee organization activities are in compliance with laid down policies, standards, procedures, and applicable laws and regulations.

- Quality and continuous improvement are adopted in the management and operating processes.

- Identify and manage opportunities for improving the processes, policies, standards, administrative and management control

Most organizations opt for a the Third party auditor (TPA), i.e auditors that don’t form a part of the organization, usually coupled with an internal SPOC to interface with the auditee’s (organization being audited) management. Key audit firms, commonly referred to as BIG-4 perform audit for major corporations across the globe.

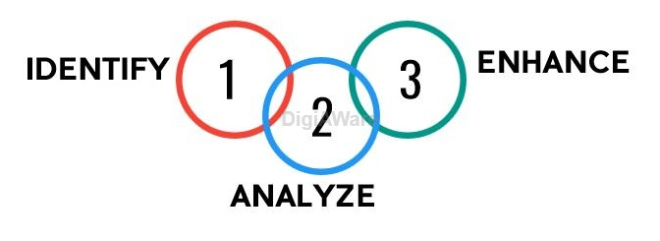

The key activities of the TPA include the following:

- Design audit framework, audit plan and audit control points. This also includes preparing audit checklist, report templates etc.

- Perform risk assessment to identify risks and manage them effectively

- SLA Monitoring & Measurement, Penalty calculation and Down time analysis

- Auditing the process utilities and submission of recommendations for improvements on quarterly basis.

- Proactive monitoring and auditing of processes and technology deployed in the system and timely recommendations for up gradation and fine tuning of configuration are to be provided on quarterly/bi-annual/annual basis

- Compliant handling mechanism Audit

- User Feedback

- Exit process support

If not already done, on-board an established TPA toady and stop worrying about any compliance and legal violations.

Hi there, I found your site via Google while looking for a related topic, your web site came up, it looks great. I’ve bookmarked it in my google bookmarks.

This will be a great web site, will you be involved in doing an interview about how you developed it? If so e-mail me!

I enjoyed reading about the various HR metrics and how they can be used to measure success.

I was recommended this web site by my cousin. I’m not sure whether this post is written by him as no one else know such detailed about my trouble. You’re amazing! Thanks!

Hey there! I’m at work browsing your blog from my new iphone 4! Just wanted to say I love reading through your blog and look forward to all your posts! Carry on the excellent work!

obviously like your website but you have to check the spelling on quite a few of your posts. Many of them are rife with spelling problems and I find it very troublesome to tell the truth nevertheless I抣l surely come back again.

Thanks for ones marvelous posting! I genuinely enjoyed reading it, you may be a great author.I will be sure to bookmark your blog and may come back later in life. I want to encourage you continue your great work, have a nice evening!

Good article . Thanks for the information.